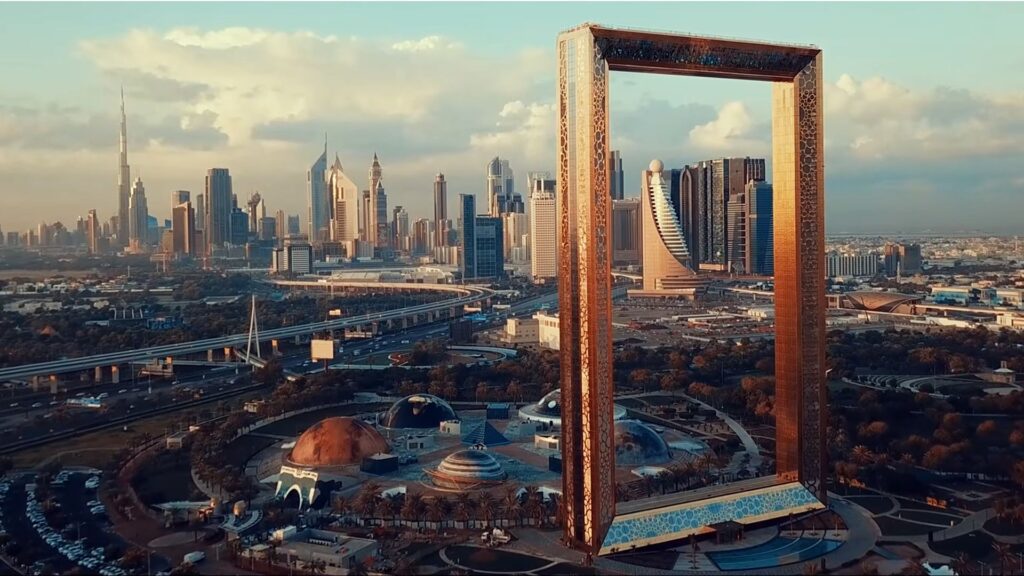

The United Arab Emirates (UAE) is a strategic gateway to global markets, attracting foreign investors with its dynamic economy and ease of doing business. However navigating the nuances of establishing your company in the UAE can be complex. This blog delves into the key considerations, highlighting the two primary options: Mainland companies and Free Zone companies.

Choosing Your Business Structure:

Selecting the right jurisdiction is crucial, much like choosing your business activities. Investors typically have two options:

- Mainland Company: Establish your presence within one of the seven Emirates (e.g., Dubai, Abu Dhabi).

- Free Zone Company: Set up in a designated Free Zone offering specialized regulations and benefits.

The UAE allows 100% ownership where foreign investors can be the sole owners in their business venture. This does away with the requirement to have a local sponsor.

There are over 45 free zones in the UAE, and each Emirate has one or more free zones, regulated by a separate free zone authority and governed by regulations.

Mainland vs. Free Zone:

Weighing the Advantages

Understanding the unique advantages of each helps you make an informed decision:

Feature Mainland Company Free Zone Company Market Access Full access to the entire UAE market Limited to specific free zone and activities within it Foreign Ownership 100% foreign ownership allowed 100% foreign ownership allowed Profit & Capital Repatriation Repatriate 100% of profits and capital freely Repatriate 100% of profits and capital freely Company Formation Process Standard company formation process, can be longer Streamlined and faster process within the chosen free zone Corporate Bank Accounts Relatively easy to obtain Requires approval from specific banks operating within the free zone Infrastructure & Facilities Standard UAE infrastructure & facilities Access to advanced infrastructure and work facilities within the free zone Restrictions & Regulations Subject to UAE mainland laws and regulations Subject to specific free zone regulations, often less stringent Visa Options Wider range of visa options, including family visas Limited visa options, typically employment visas only VAT Subject to 5% VAT Some free zones offer VAT exemption for specific activities Remember: Free Zone companies generally face restrictions on directly serving the local UAE market. Mainland companies offer wider reach but involve slightly more complex setup procedures.

Navigating this Journey with Trinity Group

The company setup landscape is constantly evolving, with new laws impacting business structures, documentation, and licenses. Trinity Group offers clear and transparent advice to guide you through these complexities.

We’re here to help.

- Contact us at +971 4 447 8931

- Email us at companyformation@trinitygroup.eu